If you are looking for one brand for all your CBD products then NuX CBD is perfect for you. Where one brand makes good CBD oil and another makes good CBD gummies, Nu X CBD has mastered all of them. All their products are top-notch, be that CBD vapes, pre-rolls, tinctures, soft gels, as well […]

Read MoreWhat is CBD Isolate? Top 5 CBD Isolate Products

While full-spectrum and broad-spectrum CBD products are quite famous, CBD isolates products are less popular so it makes it even more difficult to find good quality and reliable products, even though it is the purest form of CBD. But you do not need to worry. In this article, we are going to tell you all […]

Read MoreIs Delta 8 Legal in Wisconsin? Laws & Legality in 2022-23

Delta 8 THC is a cannabis extract that many people are curious about. Some people claim that it has healing benefits, while others say that it’s just another way to get high. So what’s the truth? Is Delta 8 legal in Wisconsin? And what are the effects of this chemical compound? Read on to find […]

Read MoreHow To Pass A Hair Follicle Drug Test

Does the idea of a hair follicle drug test strike fear into your heart? Maybe you’re a casual user of substances. Maybe you use them more regularly. Maybe you’ve stopped using substances for weeks or even months. But even if that’s the case, a hair follicle test can cause you serious problems. To understand how […]

Read MoreNexxus Old Style Aloe Rid Shampoo Review

Are you worried about passing a drug test? Have you used substances in the past 90 days that may show up on a hair follicle test? Hair follicle drug tests are often used by employers and law enforcement because they detect drug use up to 90 days after the fact. You might not have done […]

Read MoreTestclear Review For 2022-2023

Are you worried about passing a drug test? Testclear is a company that was made for you. The company sells products that can help you pass any kind of drug test. They also sell at-home drug tests and kits so you can find out ahead of time whether you’ll pass. Testclear has products that can […]

Read MoreIs Delta-8 Legal in Connecticut? (Usage, Legality, States, and Future)

Now that Delta 8 is gaining popularity, more and more details regarding Delta 8 are coming out. Since this information has become public that Delta 8 THC is available in plants in a minimal quantity and most companies synthesize it with the help of enzymes, acids, and bases using several chemical processes, and it can […]

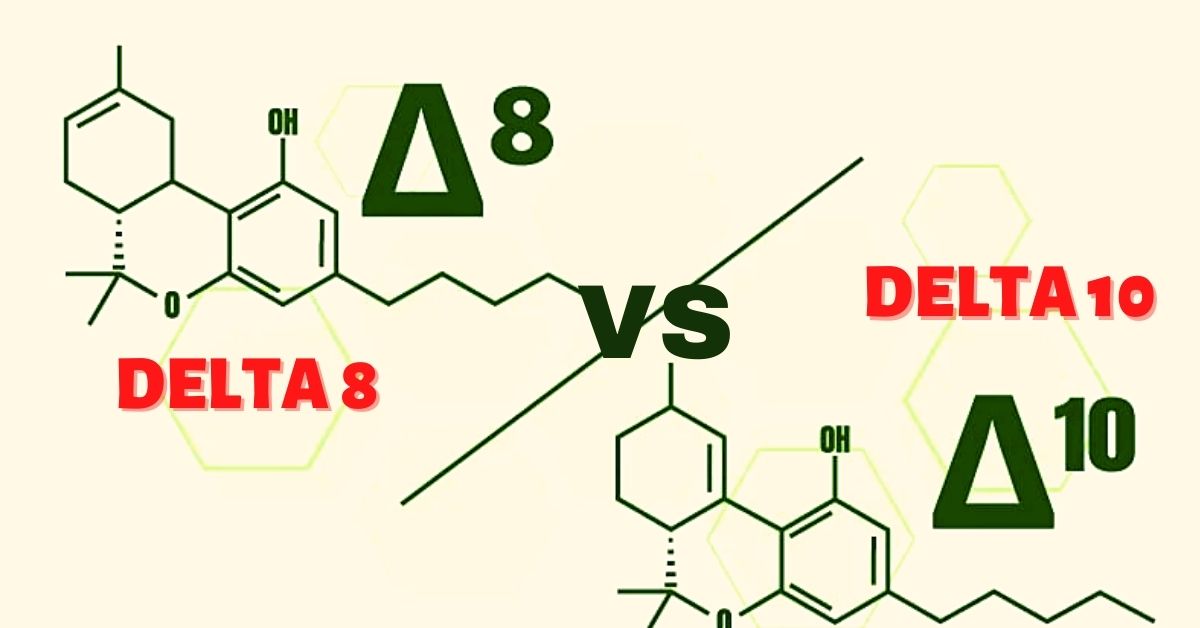

Read MoreDelta 8 Vs Delta 10 THC: Know the Difference

Now that THCs are getting famous, brands have started making products with different THCs. If you consume hemp-derived products then you must be aware of Delta 7, Delta 8, Delta 9, and Delta 10 products. All this can be very confusing. So in this article, we are going to explain the difference between Delta 8 […]

Read MoreDad Grass Review: Why is it so Famous?

Dad grass is a new brand that immediately became famous for its products. They manufacture smokable CBD hemp in the form of joints. The main motto of this brand is to provide people with smokable hemp, that is not too high and at the same time gives them nostalgia. In this article, we are going […]

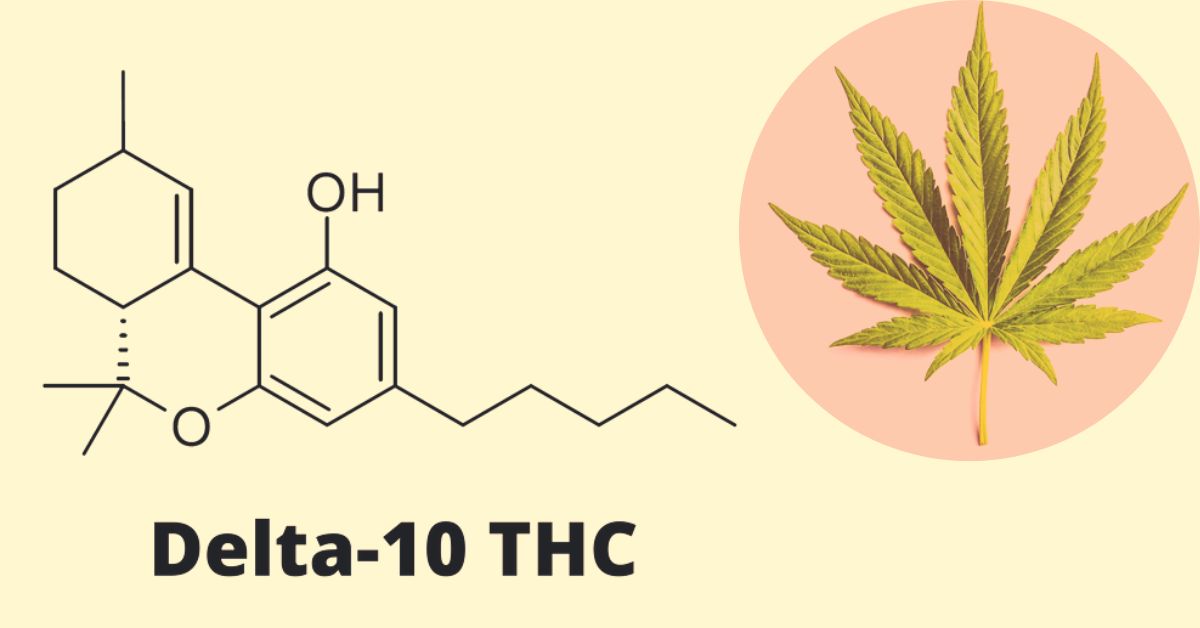

Read MoreWhat is Delta 10 THC? Where to Get Delta 10 Products

Now that Delta 8 is under controversy and most states are planning to either regulate or ban it, brands have come up with a new THC, Delta 10 THC. Since it is new in the market, most people do not know much about it, so here we are to help you. In this article, we […]

Read More